Image 1 of 3

Image 1 of 3

Image 2 of 3

Image 2 of 3

Image 3 of 3

Image 3 of 3

Section 83(b) Election

About This Document

The Section 83(b) Election is a tax filing that allows a taxpayer to elect to pay income taxes on the fair market value of restricted property (such as startup equity) at the time of grant, rather than when it vests.

Filing this election can significantly reduce taxes if the property’s value increases in the future, locking in a lower tax basis.

Who Should Use This Template

Startup founders, employees, and consultants receiving restricted stock, restricted units, or membership interests subject to vesting

Entrepreneurs awarded early-stage equity that will appreciate in value over time

Companies offering equity compensation tied to service-based vesting schedules

Anyone seeking to minimize future tax burdens by electing early recognition

What the Template Includes

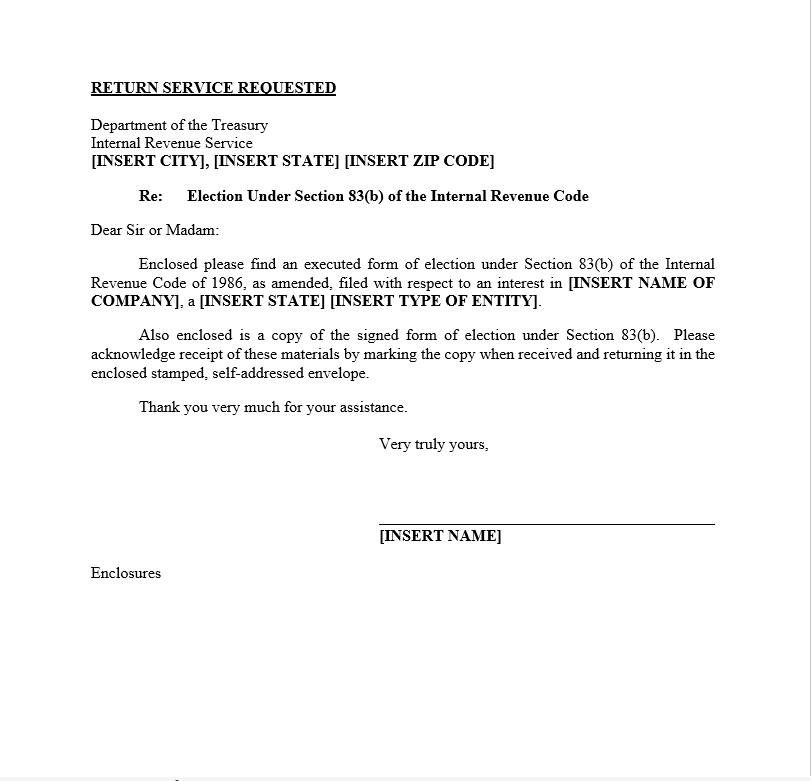

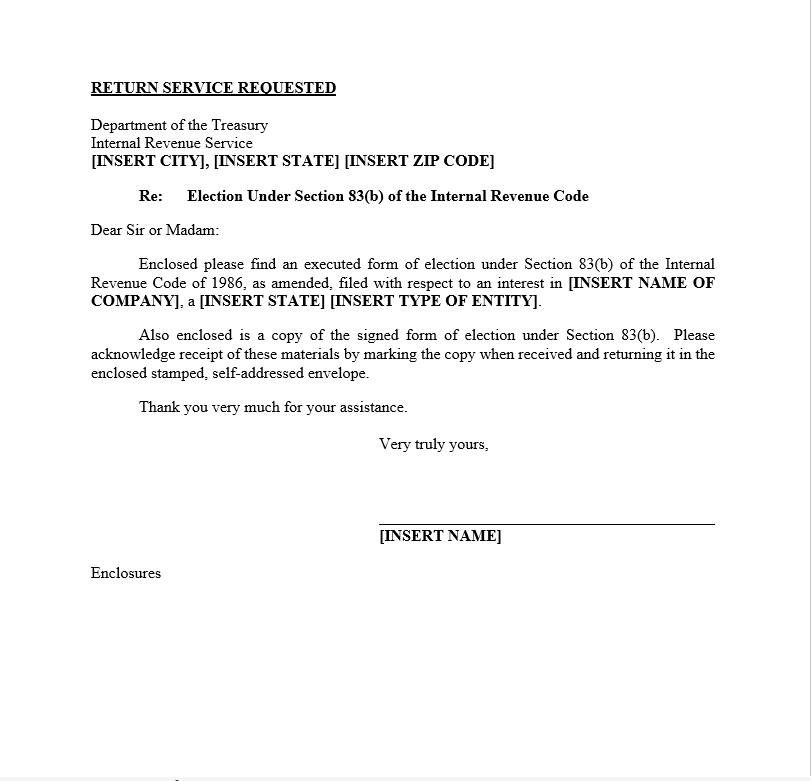

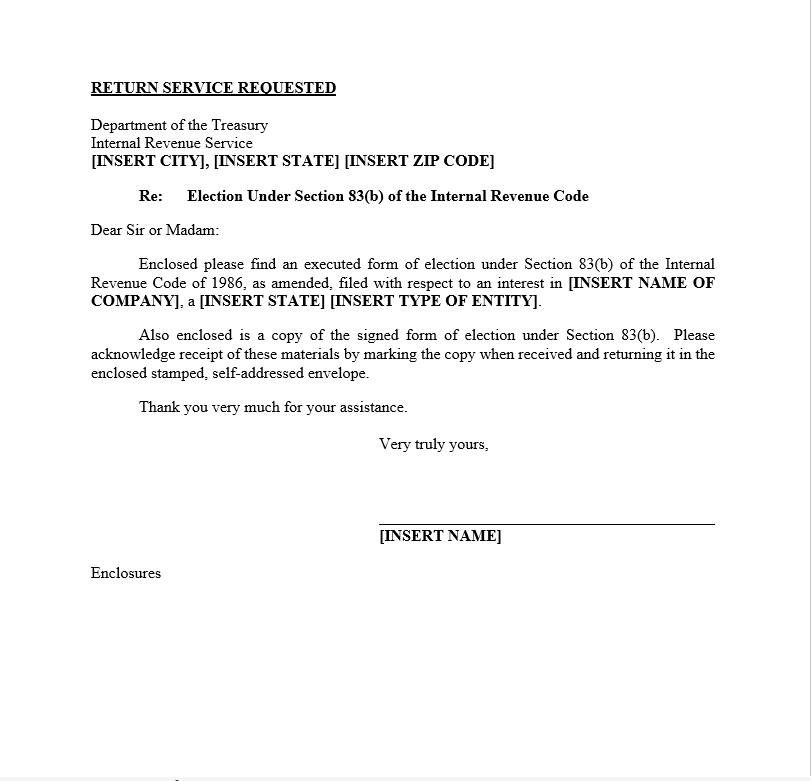

Cover letter for mailing to the Internal Revenue Service (IRS)

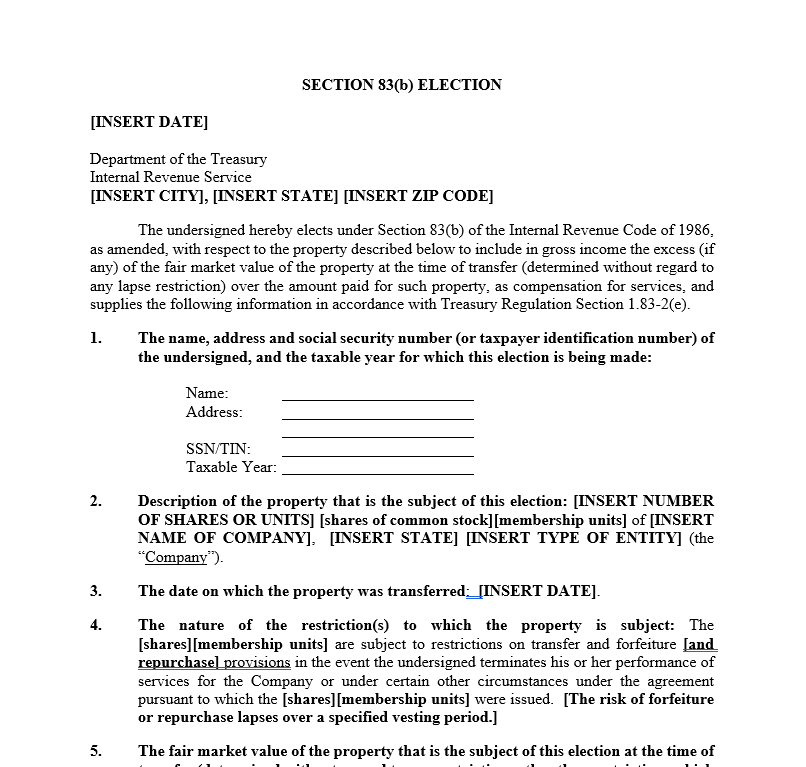

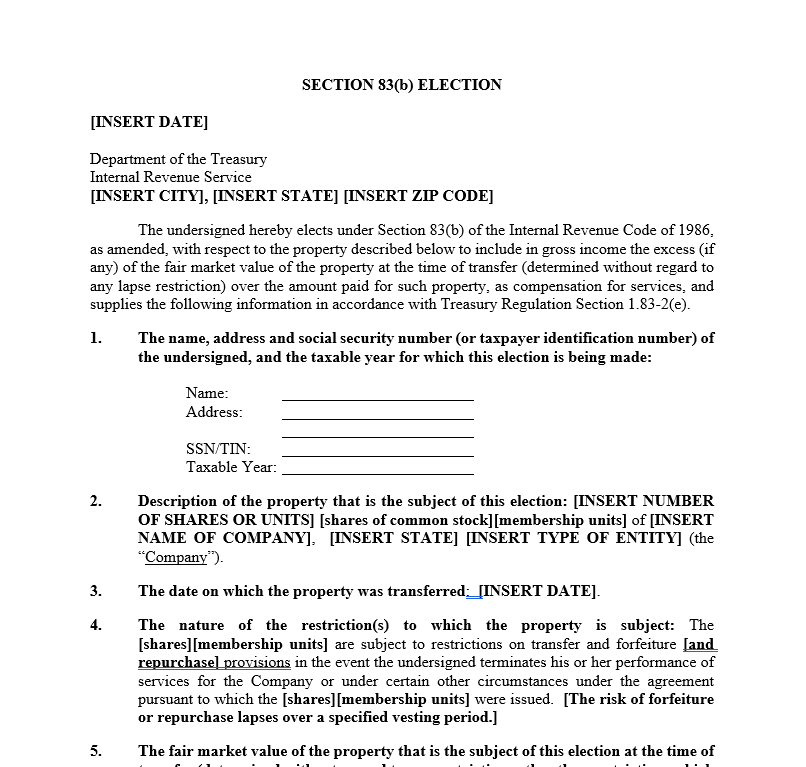

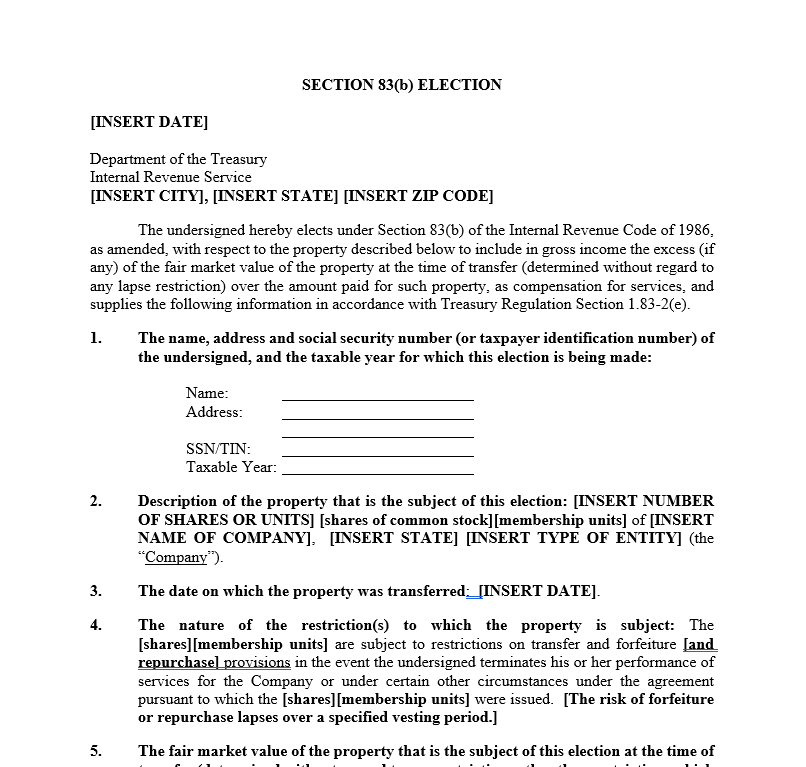

Formal Section 83(b) Election Statement, including:

Taxpayer’s name, address, and Social Security Number (SSN)

Description of the property (e.g., shares of common stock or membership units)

Date of transfer

Description of the restrictions on the property (e.g., forfeiture or repurchase rights)

Fair market value at transfer and purchase price

Amount of ordinary income to report

Filing instructions, including mailing to the IRS within 30 days

Editable Word format for easy customization

Instructions for Completing the Template

Fill in:

Name, Home Address, and Social Security Number (or TIN)

Number and type of shares or units granted

Name of Company, State of Formation, and Entity Type (Corporation, LLC, etc.)

Date of transfer (usually the grant date)

Fair Market Value at the time of grant (typically nominal for early-stage startups)

Purchase Price paid for the shares (often $0 or nominal)

Amount of gross income to be reported (fair market value minus purchase price)

Mail the following to the IRS:

Original signed 83(b) Election

Cover letter requesting return acknowledgment

Copy of the Election for IRS receipt stamp (optional)

Stamped, self-addressed envelope (optional but recommended)

Provide a copy to the Company and retain a copy for your personal tax records.

Attach a copy to your personal tax return for the year the property is transferred.

File the election within 30 days of the grant date — this deadline is absolute and cannot be extended.

Important Reminder

This document is provided as a template to assist with the Section 83(b) election process.

It does not constitute legal or tax advice. You should consult a qualified attorney or tax advisor to ensure the 83(b) Election is appropriate for your specific grant, complies with IRS rules, and is filed correctly and timely to avoid negative tax consequences.

About This Document

The Section 83(b) Election is a tax filing that allows a taxpayer to elect to pay income taxes on the fair market value of restricted property (such as startup equity) at the time of grant, rather than when it vests.

Filing this election can significantly reduce taxes if the property’s value increases in the future, locking in a lower tax basis.

Who Should Use This Template

Startup founders, employees, and consultants receiving restricted stock, restricted units, or membership interests subject to vesting

Entrepreneurs awarded early-stage equity that will appreciate in value over time

Companies offering equity compensation tied to service-based vesting schedules

Anyone seeking to minimize future tax burdens by electing early recognition

What the Template Includes

Cover letter for mailing to the Internal Revenue Service (IRS)

Formal Section 83(b) Election Statement, including:

Taxpayer’s name, address, and Social Security Number (SSN)

Description of the property (e.g., shares of common stock or membership units)

Date of transfer

Description of the restrictions on the property (e.g., forfeiture or repurchase rights)

Fair market value at transfer and purchase price

Amount of ordinary income to report

Filing instructions, including mailing to the IRS within 30 days

Editable Word format for easy customization

Instructions for Completing the Template

Fill in:

Name, Home Address, and Social Security Number (or TIN)

Number and type of shares or units granted

Name of Company, State of Formation, and Entity Type (Corporation, LLC, etc.)

Date of transfer (usually the grant date)

Fair Market Value at the time of grant (typically nominal for early-stage startups)

Purchase Price paid for the shares (often $0 or nominal)

Amount of gross income to be reported (fair market value minus purchase price)

Mail the following to the IRS:

Original signed 83(b) Election

Cover letter requesting return acknowledgment

Copy of the Election for IRS receipt stamp (optional)

Stamped, self-addressed envelope (optional but recommended)

Provide a copy to the Company and retain a copy for your personal tax records.

Attach a copy to your personal tax return for the year the property is transferred.

File the election within 30 days of the grant date — this deadline is absolute and cannot be extended.

Important Reminder

This document is provided as a template to assist with the Section 83(b) election process.

It does not constitute legal or tax advice. You should consult a qualified attorney or tax advisor to ensure the 83(b) Election is appropriate for your specific grant, complies with IRS rules, and is filed correctly and timely to avoid negative tax consequences.