Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

Convertible Note Template

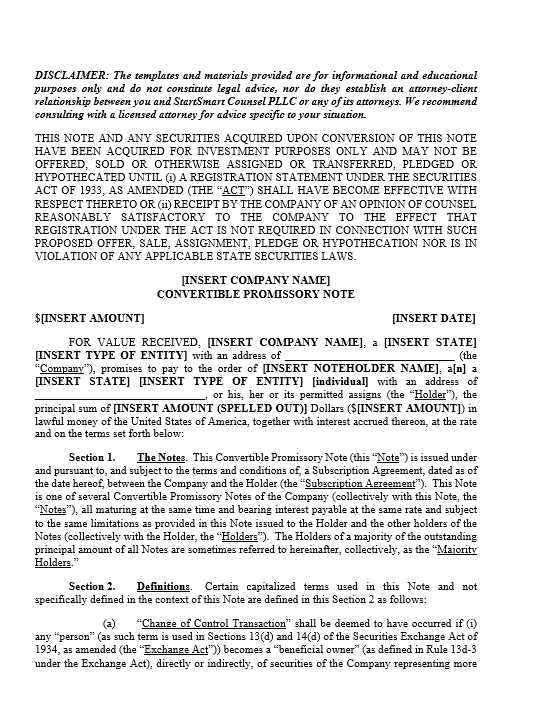

About This Document

This Convertible Note is a form of early-stage financing where an Investor loans money to a Company, and the principal plus interest may later convert into equity (shares of stock) upon certain triggering events, such as a future investment round or a sale of the company.

It allows startups to raise capital quickly without setting an initial company valuation.

Who Should Use This Template

Startups and early-stage companies raising pre-seed or seed capital without immediately pricing an equity round

Angel investors or early backers providing bridge financing to emerging companies

Companies seeking a flexible structure that can convert into shares during future financings or liquidity events

Founders preparing for venture capital rounds who want simple interim funding solutions

What the Template Includes

Loan terms: principal amount, interest rate, maturity date

Automatic or optional conversion into equity during:

Qualified financing rounds

Change of control events

Maturity of the note

Definition of key terms: Qualified Financing, Change of Control, Senior Indebtedness

Rights of the noteholder to receive discounts or valuation caps on conversion

Events of default (e.g., nonpayment, insolvency, bankruptcy) and associated remedies

Subordination to Senior Indebtedness (protects lenders providing larger loans later)

No prepayment without consent of majority noteholders

Limitation of liability, waiver of jury trial, and governing law (Delaware by default)

Editable Word format for easy adjustment

Instructions for Completing the Template

Insert the Company Name, Investor (Holder) Name, Principal Amount, and Effective Date.

Fill in key financial terms:

Interest Rate (e.g., 5%-8% per annum is common)

Maturity Date (usually 12–24 months after issuance)

Qualified Financing Threshold (e.g., minimum $1M raised)

Valuation Cap and Discount Rate, if applicable

Customize whether conversion happens automatically or at Investor’s election upon various events.

Update jurisdiction if not using Delaware law.

Finalize all parties' details at the signature blocks, including titles if corporations or LLCs are involved.

After signing, maintain a copy with your corporate records and update your capitalization table to account for potential conversions.

Important Reminder

This document is provided as a template to assist with standard convertible note financing arrangements.

It does not constitute legal advice. You should consult a qualified attorney to review and tailor this Convertible Note to ensure it fits your fundraising strategy, securities law compliance, and specific investor negotiations.

About This Document

This Convertible Note is a form of early-stage financing where an Investor loans money to a Company, and the principal plus interest may later convert into equity (shares of stock) upon certain triggering events, such as a future investment round or a sale of the company.

It allows startups to raise capital quickly without setting an initial company valuation.

Who Should Use This Template

Startups and early-stage companies raising pre-seed or seed capital without immediately pricing an equity round

Angel investors or early backers providing bridge financing to emerging companies

Companies seeking a flexible structure that can convert into shares during future financings or liquidity events

Founders preparing for venture capital rounds who want simple interim funding solutions

What the Template Includes

Loan terms: principal amount, interest rate, maturity date

Automatic or optional conversion into equity during:

Qualified financing rounds

Change of control events

Maturity of the note

Definition of key terms: Qualified Financing, Change of Control, Senior Indebtedness

Rights of the noteholder to receive discounts or valuation caps on conversion

Events of default (e.g., nonpayment, insolvency, bankruptcy) and associated remedies

Subordination to Senior Indebtedness (protects lenders providing larger loans later)

No prepayment without consent of majority noteholders

Limitation of liability, waiver of jury trial, and governing law (Delaware by default)

Editable Word format for easy adjustment

Instructions for Completing the Template

Insert the Company Name, Investor (Holder) Name, Principal Amount, and Effective Date.

Fill in key financial terms:

Interest Rate (e.g., 5%-8% per annum is common)

Maturity Date (usually 12–24 months after issuance)

Qualified Financing Threshold (e.g., minimum $1M raised)

Valuation Cap and Discount Rate, if applicable

Customize whether conversion happens automatically or at Investor’s election upon various events.

Update jurisdiction if not using Delaware law.

Finalize all parties' details at the signature blocks, including titles if corporations or LLCs are involved.

After signing, maintain a copy with your corporate records and update your capitalization table to account for potential conversions.

Important Reminder

This document is provided as a template to assist with standard convertible note financing arrangements.

It does not constitute legal advice. You should consult a qualified attorney to review and tailor this Convertible Note to ensure it fits your fundraising strategy, securities law compliance, and specific investor negotiations.