Image 1 of 2

Image 1 of 2

Image 2 of 2

Image 2 of 2

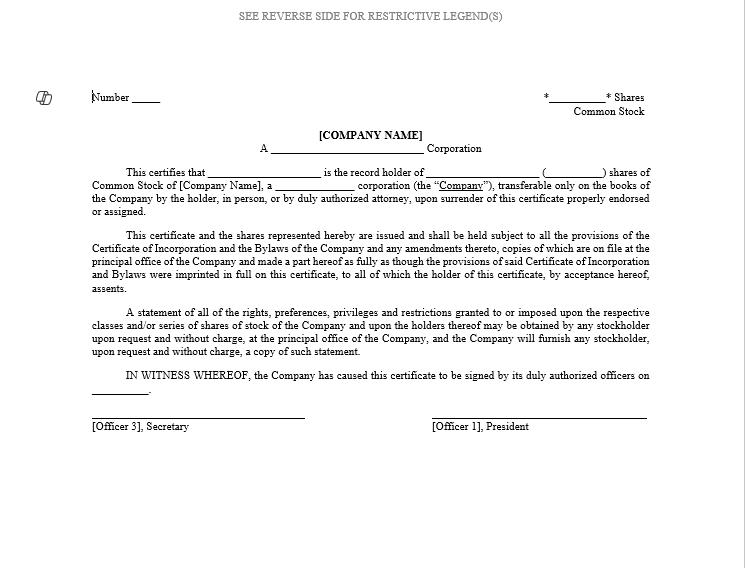

Common Stock Certificate

About This Document

This Common Stock Certificate serves as formal proof of stock ownership in a corporation.

It identifies the shareholder, the number of shares held, and outlines any restrictions on transfer. It is an important part of the corporation’s legal and financial records.

Who Should Use This Template

Corporations issuing founder shares, employee shares, or investor stock

Startup companies completing initial stock issuances

Businesses formalizing stock ownership for record-keeping, transfers, and legal compliance

Companies needing to provide shareholders with official ownership certificates

What the Template Includes

Company name, shareholder name, and number of shares

Legal language governing the transferability of shares

Statement about rights, preferences, privileges, and restrictions related to the stock

Space for required signatures from corporate officers (typically President and Secretary)

Optional restrictive legends referencing:

Securities Act of 1933 compliance

Company bylaws and stockholder agreements

Right of first refusal or co-sale restrictions

Voting and transfer limitations

Assignment section for transferring shares (on the reverse side)

Instructions for Completing the Template

Fill in the Company Name, State of Incorporation, and Share Certificate Number (e.g., Certificate No. 001).

Insert the Shareholder’s full legal name and the exact number of shares issued.

Specify the date of issuance.

Ensure the certificate is signed by the authorized President and Secretary (or other designated officers).

Review and customize any restrictive legends depending on your stockholder agreements or offering conditions.

Maintain a corresponding record in the corporation’s stock ledger to track share ownership properly.

If shares are later transferred, use the assignment section provided on the back of the certificate.

Important Reminder

This document is provided as a template to assist with standard stock issuance processes.

It does not constitute legal advice. You should consult qualified legal counsel to ensure the stock certificate complies with all applicable corporate, securities, and contract laws, especially if restrictions on transfer apply.

About This Document

This Common Stock Certificate serves as formal proof of stock ownership in a corporation.

It identifies the shareholder, the number of shares held, and outlines any restrictions on transfer. It is an important part of the corporation’s legal and financial records.

Who Should Use This Template

Corporations issuing founder shares, employee shares, or investor stock

Startup companies completing initial stock issuances

Businesses formalizing stock ownership for record-keeping, transfers, and legal compliance

Companies needing to provide shareholders with official ownership certificates

What the Template Includes

Company name, shareholder name, and number of shares

Legal language governing the transferability of shares

Statement about rights, preferences, privileges, and restrictions related to the stock

Space for required signatures from corporate officers (typically President and Secretary)

Optional restrictive legends referencing:

Securities Act of 1933 compliance

Company bylaws and stockholder agreements

Right of first refusal or co-sale restrictions

Voting and transfer limitations

Assignment section for transferring shares (on the reverse side)

Instructions for Completing the Template

Fill in the Company Name, State of Incorporation, and Share Certificate Number (e.g., Certificate No. 001).

Insert the Shareholder’s full legal name and the exact number of shares issued.

Specify the date of issuance.

Ensure the certificate is signed by the authorized President and Secretary (or other designated officers).

Review and customize any restrictive legends depending on your stockholder agreements or offering conditions.

Maintain a corresponding record in the corporation’s stock ledger to track share ownership properly.

If shares are later transferred, use the assignment section provided on the back of the certificate.

Important Reminder

This document is provided as a template to assist with standard stock issuance processes.

It does not constitute legal advice. You should consult qualified legal counsel to ensure the stock certificate complies with all applicable corporate, securities, and contract laws, especially if restrictions on transfer apply.